Understanding the Advantages and Difficulties of Developing an Offshore Trust Fund for Property Protection

When thinking about possession security, establishing an overseas trust fund may appear attractive. It uses personal privacy, prospective tax advantages, and a method to protect your possessions from lenders. You'll require to browse legal considerations and conformity concerns that differ across jurisdictions.

What Is an Offshore Count On?

An overseas count on is a lawful arrangement where you transfer your properties to a count on that's developed outside your home country. You can assign a trustee, that will manage the trust according to your desires.

Key Advantages of Offshore Depends On for Property Defense

When thinking about offshore trust funds for possession security, you'll discover numerous essential advantages that can profoundly influence your monetary safety and security. These counts on provide enhanced privacy, tax obligation benefits, and a legal guard from creditors. Understanding these advantages can assist you make informed choices about your properties.

Improved Personal Privacy Security

Numerous people seek overseas trusts not just for monetary benefits, however also for improved privacy security. By developing an offshore depend on, you can separate your individual properties from your public identity, which can hinder unwanted interest and possible legal cases. Most overseas territories provide solid confidentiality legislations, making it difficult for others to access your depend on details. This added layer of privacy safeguards your economic affairs from prying eyes, whether it's financial institutions, litigants, or perhaps intrusive neighbors. On top of that, you can keep greater control over exactly how your properties are managed and distributed without revealing delicate details to the public. Eventually, an overseas trust can be a powerful device for protecting your personal privacy while safeguarding your wide range.

Tax Advantages and Incentives

Beyond enhanced privacy protection, offshore counts on likewise supply substantial tax obligation advantages and rewards that can furthermore enhance your monetary approach. By developing an overseas trust, you might appreciate minimized tax liabilities relying on the territory you choose. Numerous countries provide desirable tax obligation rates or exceptions for depends on, allowing your properties to grow without the burden of too much taxation. In addition, earnings generated within the depend on might not undergo regional tax obligations, protecting more wide range for you and your beneficiaries. Moreover, specific offshore territories offer rewards for foreign capitalists, making it simpler for you to make the most of returns. In general, leveraging these tax obligation benefits can be a clever action in protecting and growing your possessions efficiently (Offshore Trusts).

Legal Guard From Creditors

Developing an overseas trust fund gives you a powerful legal shield against creditors, ensuring your assets remain safeguarded when faced with monetary difficulties. By putting your possessions in an overseas depend on, you produce a barrier that makes it challenging for lenders to access them. This legal framework can prevent prospective claims and cases, as financial institutions might discover it challenging to permeate the count on's securities. Additionally, offshore trust funds often run under various lawful jurisdictions, which can offer additional benefits in property security. You gain satisfaction, recognizing your riches is protected from unexpected financial troubles. It is essential to recognize the lawful requirements and effects to completely profit from this strategy, making certain compliance and performance in securing your assets.

Lawful Considerations When Developing an Offshore Trust Fund

When you're establishing an offshore depend on, understanding the legal landscape is crucial. You'll need to very carefully pick the best territory and guarantee compliance with tax laws to protect your possessions properly. Disregarding these aspects can lead to expensive blunders down the line.

Territory Selection Criteria

Choosing the appropriate jurisdiction for your overseas depend on is necessary, as it can considerably influence the efficiency of your property security strategy. The simplicity of trust facility and ongoing administration also matters; some jurisdictions supply streamlined procedures. Additionally, examine any personal privacy laws that secure your information, as confidentiality is commonly a key incentive for picking an offshore depend on.

Conformity With Tax Laws

Recognizing conformity with tax policies is vital for the success of your offshore count on. Failing to report your offshore trust can lead to extreme fines, including significant fines and potential criminal costs. Consulting a tax obligation expert who specializes in offshore trust funds can aid you browse these intricacies.

Prospective Tax Benefits of Offshore Depends On

While lots of people consider overseas depends on mainly for asset defense, they can likewise offer significant tax obligation advantages. By positioning your assets in an overseas count on, you could gain from extra beneficial tax obligation treatment than you would certainly obtain in your house country. Several territories have low imp source or no tax obligation prices on income created by assets kept in these trusts, which can bring about considerable savings.

In addition, if you're a non-resident beneficiary, you might prevent particular regional tax obligations entirely. This can be specifically beneficial for those aiming to protect wide range across generations. Overseas trust funds can offer adaptability in distributing income, possibly permitting you to time distributions for tax obligation performance.

However, it's vital to consult with a tax obligation specialist acquainted with both your home country's regulations and the overseas jurisdiction's guidelines. Capitalizing on these potential tax benefits needs mindful preparation and compliance to guarantee you stay within lawful borders.

Obstacles and Threats Linked With Offshore Trusts

Although offshore counts on can provide countless advantages, they also come with a variety of challenges and risks that you should thoroughly take into consideration. One substantial obstacle is the intricacy of establishing up and keeping the trust. You'll require to browse numerous lawful and regulative demands, which can be time-consuming and may require experienced advice.

In addition, prices can rise promptly, from legal charges to continuous administrative expenses. It's also important to identify that overseas depends on can draw in scrutiny from tax authorities. Otherwise structured appropriately, you may face fines or boosted tax liabilities.

In addition, the capacity for modifications in laws or political environments in the jurisdiction you have actually selected can position threats. These modifications can impact your trust's performance and your access to assets. Eventually, while offshore trust funds can be useful, understanding these obstacles is essential for making notified choices about your property security approach.

Selecting the Right Territory for Your Offshore Depend On

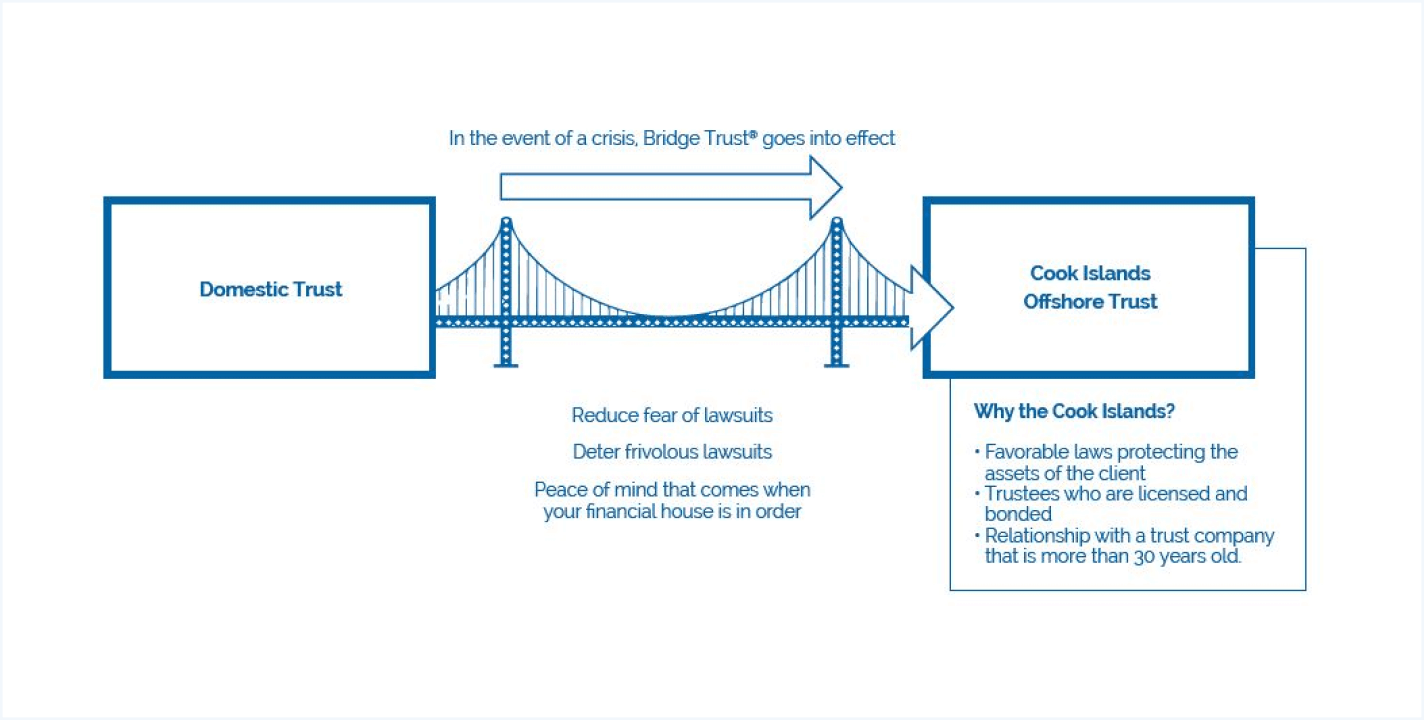

How do you select the right territory for your overseas count on? Beginning by thinking about the lawful framework and possession defense regulations of prospective territories. Look for locations recognized for strong personal privacy defenses, like the Cook Islands or Nevis. You'll likewise intend to assess the territory's reputation; some are a lot more highly regarded than others in the economic globe.

Next, think of tax ramifications. Some territories supply tax benefits, while others may not be as desirable. Offshore Trusts. Ease of access is one more aspect-- pick an area where you can quickly connect with trustees and legal experts

Lastly, take into consideration the political and economic stability of the jurisdiction. A steady atmosphere assurances your properties are less likely to be affected by unexpected changes. By carefully weighing these elements, you'll be better geared up to choose the ideal jurisdiction that lines up with your possession protection goals.

Actions to Developing an Offshore Trust Fund Efficiently

Developing an overseas count on effectively needs cautious planning and a collection of critical actions. First, you need to choose the right territory based upon your possession protection goals and lawful demands. Research the tax obligation ramifications and privacy regulations in possible places.

Next, pick a respectable trustee who understands the subtleties of overseas depends on. This individual or organization will handle the trust and warranty conformity with local laws.

As soon as you've picked a dig this trustee, draft a thorough trust fund deed describing your intentions and the recipients included. It's important to seek advice from with legal and economic consultants throughout this process to validate everything straightens with your goals.

After finalizing the paperwork, fund the count on by moving possessions. Maintain communication open with your trustee and assess the count on regularly to adapt to any type of changes in your circumstance or relevant laws. Complying with these actions vigilantly will aid you establish your offshore trust fund effectively.

Often Asked Inquiries

How Much Does It Expense to Establish up an Offshore Count On?

Establishing an overseas count on normally sets you back between Look At This $5,000 and $20,000. Elements like intricacy, territory, and specialist fees affect the overall rate. You'll intend to allocate ongoing maintenance and legal costs also.

Can I Be Both the Trustee and Recipient?

Yes, you can be both the trustee and recipient of an overseas trust, but it's vital to comprehend the lawful effects. It could make complex asset protection, so consider seeking advice from a specialist for guidance.

Are Offshore Trusts Legal for US Citizens?

Yes, offshore trusts are legal for U.S. citizens. However, you should adhere to tax obligation coverage demands and ensure the trust fund straightens with united state regulations. Consulting a lawful specialist is important to browse the intricacies entailed.

What Occurs if My Offshore Count On Is Challenged?

If your offshore trust is tested, a court might inspect its legitimacy, potentially resulting in asset healing. You'll require to give proof supporting its validity and purpose to resist any claims properly.

Just how Do I Pick a Trustee for My Offshore Depend On?

Picking a trustee for your overseas trust fund entails reviewing their experience, online reputation, and understanding of your objectives. Try to find somebody trustworthy and well-informed, and ensure they know with the laws controling overseas counts on.